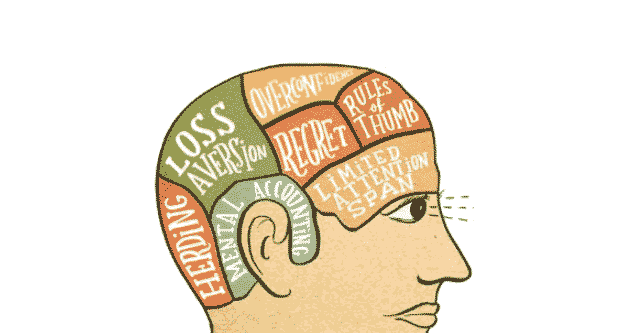

Question: What are the common Biases in investment decisions?

Understanding behavioral biases can significantly impact investment decisions, helping investors to recognize and mitigate their effects. Here are some key behavioral biases to be aware of:

1. Confirmation Bias

Confirmation bias involves seeking out information that supports our existing beliefs while ignoring contradictory evidence. For example, an investor who believes a particular tech stock will rise may only pay attention to positive news about the company, dismissing any negative reports. This narrow focus can lead to poor decision-making and reinforce incorrect beliefs, ultimately harming investment performance.

2. Herding Behavior

Herding behavior occurs when investors follow the crowd rather than conducting their own research. This can lead to irrational market behaviors, such as bubbles and crashes. During the 2008 financial crisis, many investors sold off assets simply because others were doing the same, leading to a market downturn exacerbated by collective panic. Herding is driven by the fear of missing out (FOMO) and a desire to conform to social norms.

3. Loss Aversion

Loss aversion is the tendency to prefer avoiding losses over acquiring equivalent gains. For instance, losing $100 feels more distressing than the pleasure of gaining $100. This bias can lead investors to hold onto losing investments in hopes of breaking even or selling winning investments too early to secure gains. It often results in suboptimal decision-making and can hinder long-term wealth accumulation.

4. Mental Accounting

Mental accounting refers to the practice of treating money differently based on its source or intended use. For example, an investor might be more willing to take risks with profits from previous investments (“house money”) than with their initial capital. This can lead to irrational investment choices and suboptimal portfolio performance.

5. Anchoring Bias

Anchoring bias occurs when investors rely too heavily on a specific reference point, such as a stock’s previous high price, when making decisions. This can lead to holding onto losing stocks in the hope they will return to past highs or selling winning stocks prematurely. For instance, if a stock once traded at $100 and has since fallen to $60, an investor might irrationally expect it to rebound to $100, even if market conditions have changed.

6. Negativity Bias

Negativity bias is the tendency to focus more on negative information than positive. This can lead investors to become overly cautious or pessimistic, potentially missing out on opportunities. For example, an investor might avoid a stock with strong growth potential due to recent negative news, despite its positive long-term outlook. Balancing negative and positive information is crucial for making well-rounded investment decisions.

7. Recency Bias

Recency bias occurs when recent events disproportionately influence our decisions, causing us to overlook historical data. For example, during the COVID-19 pandemic, the sudden market drop led many investors to panic sell, forgetting that markets had previously recovered from downturns like the 2008 financial crisis and the 1992 stock market crash. This short-term focus can result in missed opportunities and poor investment choices.

8. Sunk Cost Fallacy

The sunk cost fallacy is the tendency to continue investing in a losing proposition based on the resources already committed, rather than evaluating its future potential. For instance, an investor might keep funding a failing business venture because of the substantial investment already made, rather than cutting losses and reallocating resources to more promising opportunities. This behavior can lead to prolonged financial underperformance.

9. Overconfidence Bias

Overconfidence bias involves overestimating one’s knowledge and abilities, which can lead to risky investment decisions. Overconfident investors might engage in excessive trading or fail to adequately assess risks, resulting in significant losses. For example, an investor who believes they can accurately predict market movements might take on too much risk, leading to financial setbacks. Staying aware of one’s limitations is crucial for making sound investment decisions.

10. Disposition Effect Bias

Disposition effect bias refers to the tendency to classify investments as “winners” or “losers” and make decisions based on these labels. Investors might hold onto losing investments hoping for a turnaround or sell winning investments too early to lock in gains. This can increase capital gains taxes and reduce overall returns. For example, an investor might sell a stock that has appreciated significantly, missing out on further gains, while keeping a stock that has declined in value.

11. Hindsight Bias

Hindsight bias is the tendency to believe, after an event has occurred, that its outcome was predictable and obvious. This bias can lead investors to overestimate their ability to predict market movements, fostering overconfidence. For instance, after a market downturn, an investor might claim they “knew it was coming,” even though they did not take any action to mitigate the losses. Recognizing the inherent unpredictability of markets helps in maintaining a realistic view of investment forecasting abilities.

12. Familiarity Bias

Familiarity bias occurs when investors favor familiar or well-known investments over those that are less familiar. This can result in a lack of diversification and higher risk. For example, an investor might prefer to invest in domestic stocks they know well, while ignoring potentially lucrative opportunities in international markets. Embracing diversification and exploring unfamiliar investment options can lead to more balanced and robust portfolios.

13. Self-attribution Bias

Self-attribution bias involves attributing successful outcomes to one’s own actions while blaming external factors for failures. This can lead to overconfidence and a distorted view of one’s investment abilities. For instance, an investor might credit their skill for a successful trade while blaming market conditions for a poor one. Acknowledging the role of external factors and luck in investment performance can help maintain a more balanced perspective.

14. Trend-chasing Bias

Trend-chasing bias is the tendency to invest based on past performance, mistakenly believing that historical returns will predict future outcomes. For example, investors might flock to a fund that has recently performed well, influenced by increased advertising and media hype, only to find that past performance does not guarantee future results. Focusing on fundamental analysis and long-term strategies is more effective than chasing short-term trends.

By understanding these common behavioral biases, investors can make more informed and rational decisions, ultimately improving their investment outcomes and achieving their financial goals.